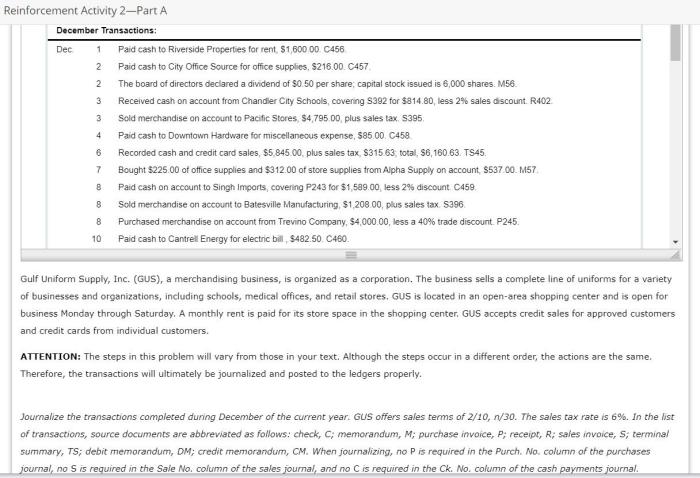

Accounting reinforcement activity 2 part a is a crucial accounting technique that plays a pivotal role in strengthening accounting knowledge and skills. This in-depth guide will delve into the intricacies of this activity, exploring its components, applications, and benefits, while also addressing potential challenges and limitations.

By delving into the nuances of accounting reinforcement activity 2 part a, we aim to empower accountants and accounting students with a comprehensive understanding of this essential practice.

As a foundational concept in accounting, accounting reinforcement activity 2 part a involves repetitive practice and exercises designed to solidify understanding of accounting principles and procedures. It is widely employed in accounting education and professional development programs to enhance proficiency in various accounting tasks.

1. Definition and Overview

Accounting reinforcement activity 2 part a refers to a set of techniques and procedures designed to enhance the effectiveness of accounting systems and processes. It involves the systematic review, analysis, and improvement of existing accounting practices to ensure they align with organizational goals, regulatory requirements, and industry best practices.

This activity is crucial for maintaining the accuracy, reliability, and efficiency of accounting systems. By identifying and addressing areas for improvement, organizations can mitigate risks, optimize resource allocation, and enhance the overall performance of their accounting function.

2. Key Components and Elements

The key components of accounting reinforcement activity 2 part a include:

- Review and analysis:A thorough examination of existing accounting practices to identify areas for improvement.

- Documentation:Clear and comprehensive documentation of accounting processes, policies, and procedures.

- Internal controls:Establishment of robust internal controls to prevent errors, fraud, and misuse of assets.

- Training and development:Ongoing training for accounting staff to ensure they are up-to-date with the latest accounting standards and best practices.

3. Methods and Procedures

The methods and procedures involved in implementing accounting reinforcement activity 2 part a typically include:

- Establish a project team:Form a team of experienced accounting professionals to lead the reinforcement activity.

- Review and analysis:Conduct a thorough review of existing accounting practices, including processes, policies, and internal controls.

- Identify areas for improvement:Analyze the findings of the review and identify areas where improvements can be made.

- Develop and implement recommendations:Formulate and implement recommendations for improving accounting practices, including documentation, internal controls, and training.

- Monitor and evaluate:Regularly monitor and evaluate the effectiveness of the implemented improvements.

Expert Answers: Accounting Reinforcement Activity 2 Part A

What is the purpose of accounting reinforcement activity 2 part a?

Accounting reinforcement activity 2 part a aims to strengthen accounting knowledge and skills through repetitive practice and exercises, fostering a deeper understanding of accounting principles and procedures.

How is accounting reinforcement activity 2 part a typically implemented?

Accounting reinforcement activity 2 part a is commonly implemented through a combination of classroom instruction, homework assignments, and online exercises, providing ample opportunities for students and accountants to practice and reinforce their understanding.

What are the benefits of using accounting reinforcement activity 2 part a?

Accounting reinforcement activity 2 part a offers numerous benefits, including improved problem-solving abilities, enhanced technical skills, increased confidence in accounting work, and ultimately, more accurate and reliable financial reporting.