Cengage accounting answers chapter 1 – Welcome to the world of accounting, where Cengage Accounting Answers for Chapter 1 serves as your guiding light. Dive into the intricacies of accounting principles, unravel the mysteries of financial statements, and conquer the challenges of asset and liability management with this comprehensive guide.

Step into the shoes of an accounting expert as we delve into the fundamental concepts that lay the foundation for a solid understanding of this essential business language.

Cengage Accounting Chapter 1 Overview

Chapter 1 of Cengage Accounting introduces the fundamental concepts and principles of accounting. It establishes the foundation for understanding the role of accounting in business and provides a framework for recording, classifying, and summarizing financial transactions.

After completing this chapter, students should be able to:

- Define accounting and explain its purpose and importance in business.

- Identify the different types of financial statements and their uses.

- Understand the accounting equation and its components.

- Prepare a trial balance to check the accuracy of recorded transactions.

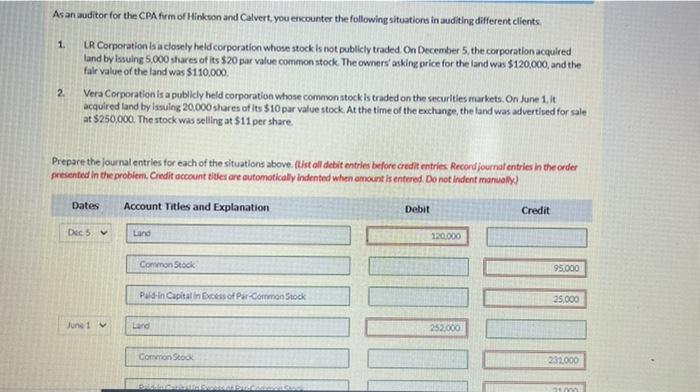

li>Record and classify transactions using debits and credits.

Accounting Basics and Principles

Accounting is a systematic process of recording, classifying, summarizing, and reporting financial transactions to provide information that is useful for decision-making.

The fundamental principles of accounting provide a framework for ensuring the accuracy and reliability of financial statements. These principles include accrual, matching, and going concern.

Accrual Accounting

Accrual accounting requires that transactions are recorded in the periods in which the events occur, regardless of when cash is received or paid. This ensures that financial statements reflect the economic substance of transactions rather than just the flow of cash.

Matching Principle

The matching principle states that expenses should be matched to the revenues they generate. This ensures that financial statements provide a clear picture of the profitability of a business.

Going Concern

The going concern principle assumes that a business will continue to operate in the foreseeable future. This assumption allows accountants to prepare financial statements based on the assumption that the business will not be liquidated.

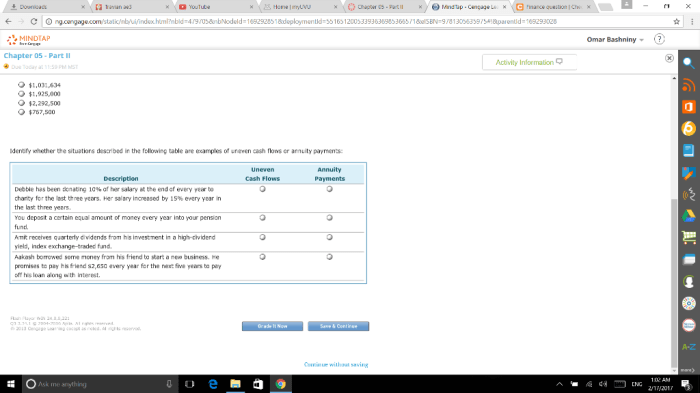

Types of Accounting Transactions

Accounting transactions are classified into five types: assets, liabilities, equity, revenues, and expenses. Assets are resources owned by a business, while liabilities are debts owed by a business. Equity represents the ownership interest in a business. Revenues are inflows of assets that result in increases in equity, while expenses are outflows of assets that result in decreases in equity.

Accounting Equation, Cengage accounting answers chapter 1

The accounting equation is a fundamental equation that states that assets are equal to liabilities plus equity. This equation is used to ensure the accuracy of financial statements and to analyze the financial health of a business.

The Accounting Cycle

The accounting cycle refers to the sequence of steps involved in recording, classifying, and summarizing financial transactions to provide information that is used to prepare financial statements.

The accounting cycle consists of the following steps:

- Recording transactions: This involves capturing financial transactions in the accounting system. Transactions are recorded in a journal, which is a chronological record of all transactions.

- Posting to the ledger: The transactions recorded in the journal are then posted to the ledger, which is a collection of accounts that track the balances of assets, liabilities, equity, revenues, and expenses.

- Preparing the trial balance: The trial balance is a report that lists all the accounts in the ledger and their balances at a specific point in time. The trial balance is used to check the accuracy of the accounting records.

- Making adjusting entries: Adjusting entries are made to update the balances of accounts at the end of the accounting period to reflect events that have occurred but have not yet been recorded. For example, an adjusting entry would be made to record depreciation expense for the period.

- Preparing financial statements: The financial statements are prepared using the information from the trial balance and the adjusting entries. The financial statements include the balance sheet, income statement, and statement of cash flows.

- Closing the books: The books are closed at the end of the accounting period to prepare for the next accounting period. The closing entries transfer the balances of the revenue and expense accounts to the retained earnings account.

The Role of the Trial Balance in the Accounting Cycle

The trial balance plays an important role in the accounting cycle by providing a check on the accuracy of the accounting records. The trial balance should balance, meaning that the total debits should equal the total credits. If the trial balance does not balance, it indicates that there is an error in the accounting records.

Different Types of Adjusting Entries and Their Impact on the Financial Statements

There are two main types of adjusting entries: accruals and deferrals.

Accrualsare adjusting entries that record revenues that have been earned but not yet received or expenses that have been incurred but not yet paid. Accruals increase the balance of an asset or expense account and decrease the balance of a liability account.

Deferralsare adjusting entries that record revenues that have been received but not yet earned or expenses that have been paid but not yet incurred. Deferrals decrease the balance of an asset or expense account and increase the balance of a liability account.

Adjusting entries are important because they ensure that the financial statements reflect the true financial position of a company. Adjusting entries can have a significant impact on the financial statements, especially if they are not made correctly.

Financial Statements

Financial statements are formal records that summarize the financial activities and position of a company. They provide information about a company’s financial performance, financial position, and cash flows.

Balance Sheet

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It shows the company’s assets, liabilities, and equity.

- Assetsare resources that the company owns or controls.

- Liabilitiesare debts that the company owes.

- Equityis the residual interest in the assets of the company after deducting liabilities.

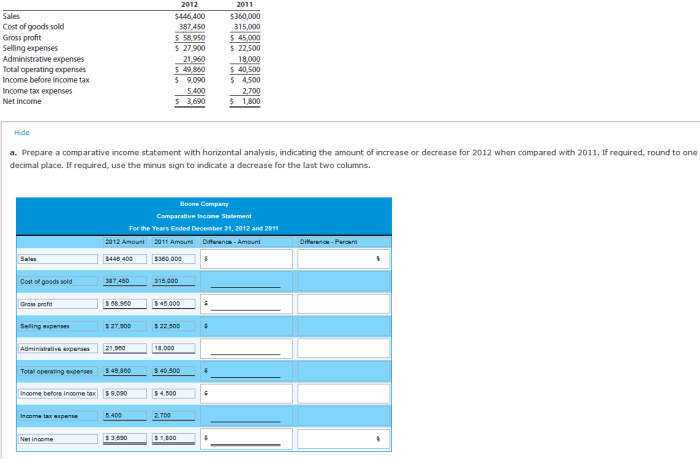

Income Statement

The income statement is a financial statement that shows a company’s financial performance over a period of time. It shows the company’s revenues, expenses, and net income.

- Revenuesare the amounts earned by the company from its normal business activities.

- Expensesare the costs incurred by the company in generating revenues.

- Net incomeis the difference between revenues and expenses.

Statement of Cash Flows

The statement of cash flows is a financial statement that shows a company’s cash inflows and outflows over a period of time. It shows how the company’s cash is being used and how it is being financed.

- Cash inflowsare the amounts of cash that the company receives.

- Cash outflowsare the amounts of cash that the company pays.

Financial statements are essential for investors, creditors, and other stakeholders to make informed decisions about a company. They provide information about a company’s financial health, profitability, and cash flow. Financial statements can also be used to compare companies to each other and to track a company’s performance over time.

Accounting for Assets and Liabilities

Assets and liabilities are fundamental elements in accounting that provide a snapshot of a company’s financial health. Assets represent economic resources owned or controlled by the company, while liabilities are financial obligations owed to external parties.

Classification of Assets and Liabilities in the Balance Sheet

In the balance sheet, assets and liabilities are classified into two primary categories: current and non-current. Current assets are expected to be converted into cash within one year, while current liabilities are payable within one year. Non-current assets and liabilities have longer time frames.

Types of Assets and Liabilities

Assets can be further categorized into tangible (physical assets) and intangible (non-physical assets). Tangible assets include cash, inventory, and property, plant, and equipment. Intangible assets include patents, trademarks, and goodwill.

Liabilities are classified as either current or non-current. Current liabilities include accounts payable, short-term loans, and accrued expenses. Non-current liabilities include long-term debt, bonds, and deferred taxes.

Accounting for Depreciation and Amortization

Depreciation and amortization are accounting techniques used to allocate the cost of long-term assets over their useful lives. Depreciation is used for tangible assets, while amortization is used for intangible assets.

Depreciation is calculated using various methods, such as the straight-line method, declining-balance method, and units-of-production method. Amortization is typically calculated using the straight-line method.

- Straight-line method:Allocates the cost of the asset evenly over its useful life.

- Declining-balance method:Allocates a larger portion of the cost to the early years of the asset’s life.

- Units-of-production method:Allocates the cost of the asset based on its usage or output.

Accounting for Equity

Equity, also known as owner’s equity or net assets, represents the residual interest in the assets of an entity after deducting its liabilities. It reflects the ownership claim of the owners or shareholders in the business.

Components of Equity

Equity is typically divided into the following components:

- Contributed capital:The amount invested by owners or shareholders in exchange for equity shares.

- Retained earnings:The accumulated profits of the business that have not been distributed to owners.

Types of Equity Accounts

The following are common types of equity accounts:

- Common stock:Represents the basic ownership interest in a corporation.

- Preferred stock:A type of stock that typically has a fixed dividend rate and priority in the distribution of assets in the event of liquidation.

- Retained earnings:The cumulative net income of the business that has not been distributed to shareholders.

Effects of Transactions on Equity

Transactions that affect equity include:

- Issuance of stock:Increases contributed capital.

- Payment of dividends:Decreases retained earnings.

- Profitable operations:Increase retained earnings.

- Loss-making operations:Decrease retained earnings.

Equity Ratios

Equity ratios are used to analyze the financial performance and health of a business. Common equity ratios include:

- Return on equity (ROE):Measures the profitability of the business relative to the equity invested by owners.

- Debt-to-equity ratio:Indicates the extent to which the business is financed through debt compared to equity.

Accounting for Revenue and Expenses: Cengage Accounting Answers Chapter 1

Revenue and expenses are fundamental elements of accounting, providing insights into a company’s financial performance. Understanding their definitions, classification, and accounting treatments is crucial for accurate financial reporting and analysis.

Definition and Classification of Revenue and Expenses

Revenuerepresents the income earned by a company from its primary operations or activities. It is typically classified as operating revenue (from core business activities) or non-operating revenue (from investments or other sources).

Expensesare the costs incurred by a company in generating revenue. They are categorized as operating expenses (directly related to business operations) or non-operating expenses (indirectly related to operations).

Accounting for Different Types of Revenue and Expenses

Revenue recognition principles dictate how and when revenue is recorded. Common types of revenue include sales revenue, service revenue, and interest revenue.

Expenses are recognized when they are incurred, regardless of when payment is made. Typical expense categories include salaries and wages, rent, utilities, and depreciation.

Calculating Gross Profit and Operating Income

Gross profitrepresents the profit earned from the sale of goods or services, calculated as revenue minus the cost of goods sold (COGS).

Operating incomemeasures the profit generated from a company’s core operations, calculated as gross profit minus operating expenses.

General Inquiries

What is the fundamental principle of accrual accounting?

Accrual accounting recognizes transactions when they occur, regardless of when cash is exchanged.

What are the three primary financial statements?

Balance sheet, income statement, and statement of cash flows.

How is depreciation calculated?

Depreciation = (Cost of asset – Salvage value) / Useful life